EURNZD is a minor currency pair that can give you a good trade each month. EURNZD trends when EUR falls and NZD rises or when EUR rises and NZD falls. Did you read the post EURUSD opening with a huge gap? Now if you have been reading my Trading Ninja blog, you must have learned by now that I believe strongly in risk management. Through experience I have learned that we can catch the big moves in the market with a very small stop loss. The secret lies in using candlestick patterns in an unconventional manner. Take a look at the following screenshot.

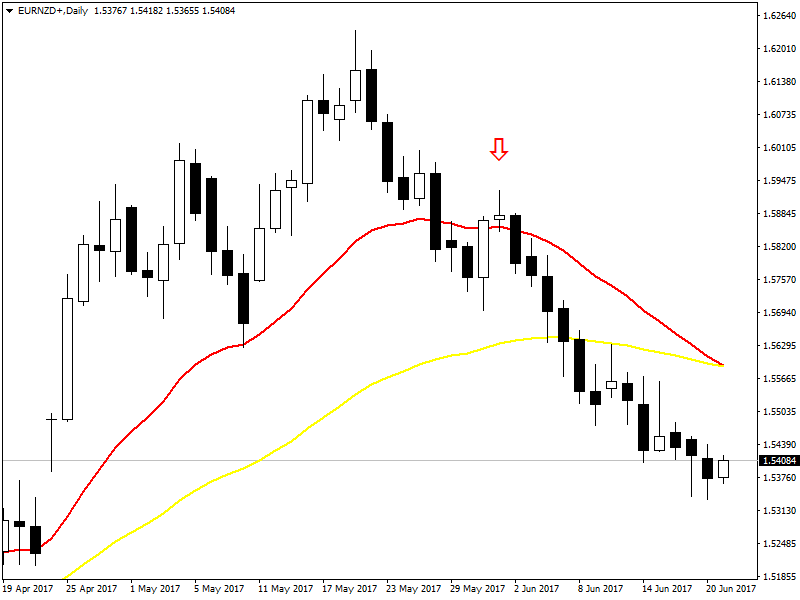

In the above screenshot you can see EURNZD daily chart. Can you see the red arrow? This is the entry point. If you look at the above chart, you can see EURNZD is already in a downtrend. For the last 8 days EURNZD has been falling. I never look for the top or bottom. It is a futile exercise to find the top/bottom. Once I am confident that we have a new trend, I look for a trade. In this case for the last 8 days EURNZD has been falling, so I start planning for a short trade. Read the post on USDJPY long trade that made 700 pips with 21 pips stop loss.

I first look at the weekly chart. Then I look at the daily chart. This gives me the idea in which direction the market is moving. Before I open a trade, I need to be confident that market is going to move 100-200-500 pips. Take profit is as important as stop loss. You see there are only 2 things in a trade:Take Profit and Stop Loss. Both are important. Stop loss is slightly more important. You should focus on it more. But if you have a erroneous take profit target, your trade will never make good profit. Your trading will be haphazard. So you have focus on both. Watch the webinar recording on the only candlestick pattern you will ever need.

First we focus on stop loss. I use candlestick patterns in finding the best entry point. I can be wrong. In trading, you will be wrong 50% of the time. If you are right 70% or more then you are a lucky trader. I have seen that we can be very profitable even if we are wrong 50% of the time. How we cater for this? We cater for this be trying to make 100-200-400 pips each time we open a trade by keeping the risk very low. Every trade needs careful planning. As I said, I already know for the last few days the EURNZD is in a downtrend which will continue. So I start planning for a short trade. Take a look at the following chart.

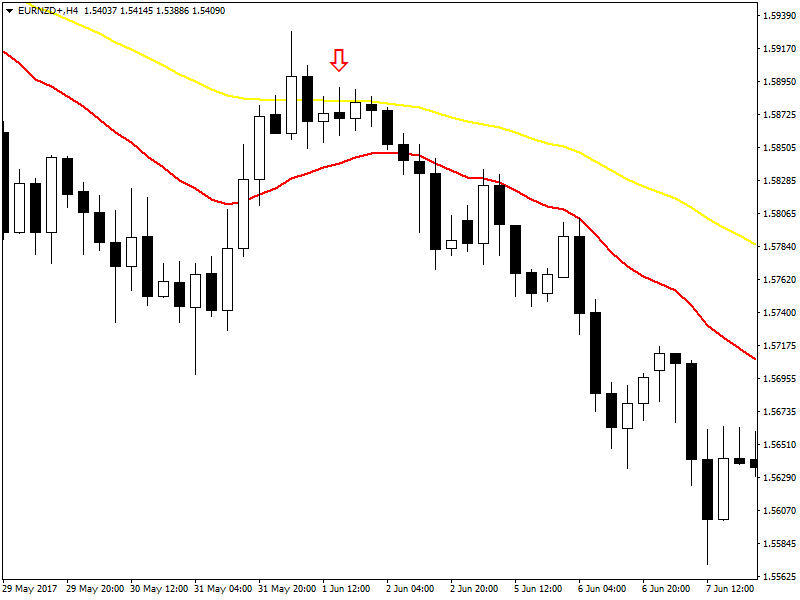

In the above screenshot,you can see EURNZD H4 chart. When I have decided on a trade, I then shift to H4 chart for finding a low risk entry. H4 chart can give good entry points. Avoid H1, M30 and M15. You will find many false signals. A candle on H4 takes 4 hours to form, so you have a good strong candle that took 4 hours. In the above screenshot you can see yellow line above red line. Yellow is EMA 21 while red is EMA 55. I use EMA 55 instead of EMA 50. Most traders love to use EMA 50 to find the long term trend in the market. But I use EMA 55. You can use EMA 50. EMA 55 is a good support/resistance level EMA 21 is also a good support/resistance level.

You can see in the above screenshot, yellow line is above red line which is an indication of a strong downtrend. Price made a retracement and went up. It hit yellow line and found strong resistance at the yellow line. Can you see the red arrow in the above screenshot? This was my entry signal. 2 candles before the entry candle, you can see the big railroad pattern which is a trend reversal pattern. I now decide to open a trade. But as said above, I wont a low risk entry. You can be wrong 50% of the time in my experience.

The high of the entry candle is 1.58911. I place a pending sell limit order with entry at 1.58870 and the stop loss at 1.58920. So my stop loss is 5 pips. Risk depends on your position size. I have $10K in my account. I cannot risk more than 2% of my account. This my risk management rule that I have to follow strictly. You should also follow this risk management rule. Never ever risk more than 2% at any time. So if I use I standard lot, 1 pip on EURZD is around $7,22. Let’s say, it is $7. So 5 pips will be $35. I can risk 2% of the account. I have $10K in my account. I can risk upto $200. If I use 6 lots, I have $210; So I use 6 lots. My risk is 2.1%.

You can see price started falling strongly and the profit target was hit after 14 days. You need to be patient. Now when the trade becomes positive means you have profit, move the stop loss to breakeven. This will ensure that if the market suddenly reverses, you don’t suffer any loss. Once you have a trade stop loss moved to breakeven, you can start looking for another trade with another currency pair. Do you chart analysis well. If you have done your chart analysis well, there is a high probability that you will find the trade hitting the profit target.

I am busy now a days. I am trying to develop an indicator based on my manual strategy. I will keep you updated on this. Most probably I will use MQL5, R, Python and Java. I can use deep learning in my trading indicator. I am thrilled with the idea of using machine learning and artificial intelligence in my trading. Algorithmic trading is the future. Big banks and hedge funds are using machine learning and artificial intelligence in trading a lot. You also need to learn how to use AI in your trading. I am developing a few courses on how to use R in your trading. I will let you know when I open the door to my courses. Read the post on how to develop algorithmic trading strategies using R.

Now coming back, I said we only need to win 50% of the time. Suppose I have an average stop loss of 10 pip and each time I make 200 pips. This gives an average Reward/Risk of 20:1/ Suppose as said above I only win 50% of the time. Will I be profitable? In 10 trades, I will win 5 trades on average and I will lose 5 trades on average. Losing 5 trades, I lose 50 pips. Winning 5 trades I make 1000 pips. So I make 950 pips net. Not bad? You can see why it is important to focus on Reward/Risk. Reward/Risk tells you the ratio your profit to your risk. As I have said EURNZD can give you one good trade per month. If you have a portfolio of 10 currency pairs, you can easily make 1000 pips per month. Now you can take profit early as well. Sometime I close the trade with 200 pip profit. When to close the trade is a difficult art to master. Just follow the trend as long as it lasts if you want to make big pips.