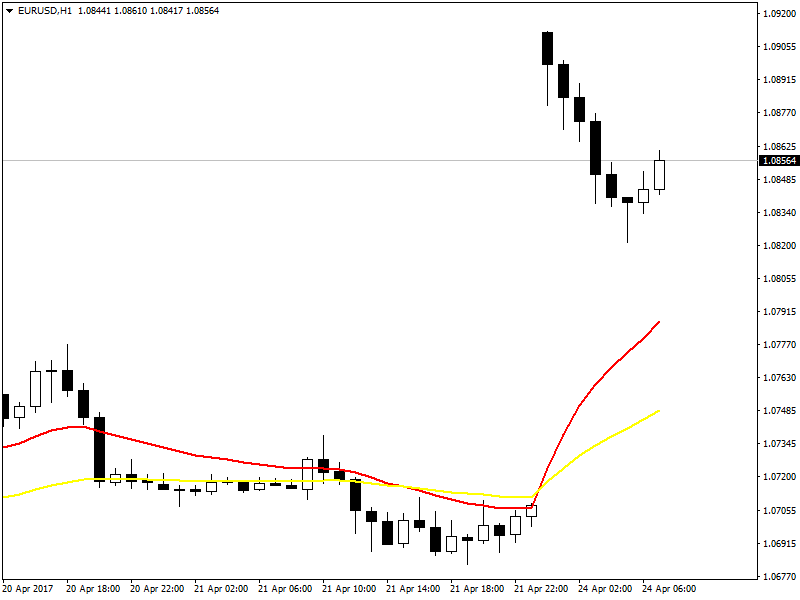

On Monday, EURUSD opened with a huge weekend gap. Last week the tension was in the air. French elections were scheduled on Sunday. Whenever there is some important political event in Europe, expect EURUSD to become nervous. This is precisely what was expected. We were expecting a huge Sunday gap. Did you read this month copy of Traders World Magazine? Take a look at the following screenshot of EURUSD H1 timefame.

As you can see in the above screenshot, there is this huge weekend gap. Trading weekend gaps is not a rocket science. Most of the time these weekend gaps occur in the direction of the trend So if you have got the trend direction correctly, you will find these weekend gaps in your favor. Of course, there are always surprises in the market and you can never be 100% sure. But most of the time, you will find the weekend gaps taking place in the direction of the trend. Read the post that explains a recent USDJPY buy trade that made 700 pips with 21 pips stop loss. This is what I do. I try to catch the big moves in the market with a small stop loss. So when you are trading in the right direction, gaps don’t cause problems. Gaps cause problems when you get caught on the wrong side.

How To Determine These Weekend Gaps?

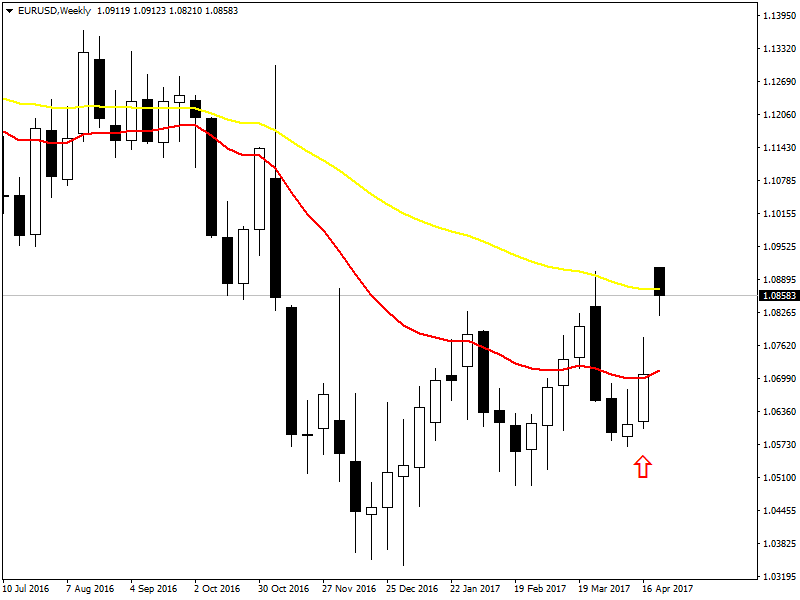

Gaps are frequent in the stock market. In the currency market. we mostly see the gaps over the weekend whenever there is some important political event. This time it was the French Presidential Elections. Somehow the market seems to know before hand the outcome of these political events. This is what we find here as well. On Friday it was clear in which direction French Elections were going for a second round. We don’t need to be a political analyst. We just need to read the charts correctly. If you can do that, you don’t need to read the news. Just read the candlestick charts. Take a look at the following EURUSD Weekly chart.

Can you see the red arrow in the above chart? Just above you can see a big bullish weekly candle. This is a signal that the next candle will also be bullish. You can see that EURUSD opened with a huge gap that is visible even on the weekly chart. Now let’s drill down to daily chart.

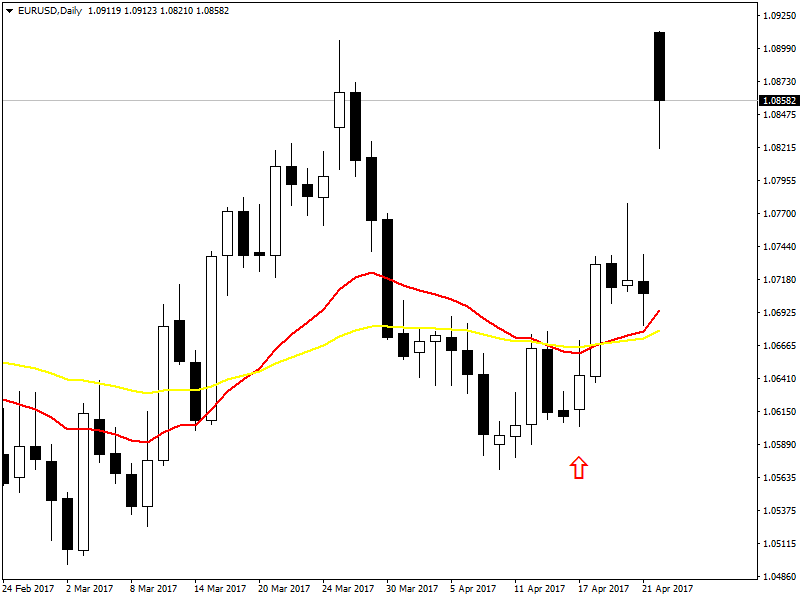

Above is the daily chart. You can see from the above daily chart that EURUSD is in an uptrend. So going long is the best strategy. Choosing the right direction is very important in trading. Did you watch these Momentum Trading Strategies Videos. Momentum trading is very powerful. You should learn it.

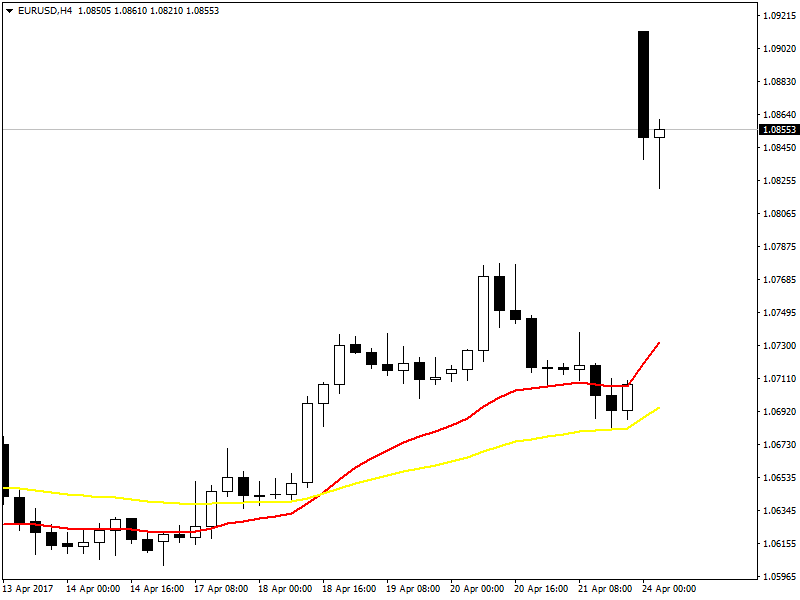

This is the H4 chart. You can see that EURUSD is in an uptrend in the above chart. The best strategy is to close the trade on Friday before the market closes and reopen the trade on Monday. This way you don’t have to worry about weekend gaps. Gaps can also develop during the week. For example, GBPUSD developed a huge 300 pip gap just after the Scotland Independence Referendum vote closed. This happened a few years ago. Initially polls had shown strong Scottish independence sentiment. But when it became clear that Scottish Independence vote wont succeed, GBPUSD developed a huge gap and corrected itself. You can see market is very dynamic and keeps on correcting itself on moment to moment basis. Another recent example is that of US Presidential Election. The day of election was a roller coaster for the market. There was no gap but market went up and down until it became certain who is going to win the elections. So staying away from the market when these political events take place is one strategy. The other strategy is to ignore them and trade what the charts are saying.

There are many traders who stay away from trading these events which is a good strategy. This is what we do. We only trade candlestick patterns. Watch this webinar recording on a candlestick pattern that has a high winrate. When we have the right candlestick pattern, we only trade that. Most of the time, we look for a trade setup that has a small stop loss that is below 15 pips. Always keep this in mind. If you miss the first time, don’t worry at all. You get a new chance after a few hours again. We trade on the H4 chart. If we miss the first time, we wait for another H4 candle for the entry. So don’t worry about missing the train. You will get many trains. Pick the one that suits you.

Now you should keep this in mind that candlestick patterns are vague and imprecise. You need experience to interpret them. On lower timeframes candlestick patterns are not that reliable. But on higher timeframes like H4, daily and weekly they are pretty reliable. So we start by looking at the weekly chart. This gives us an important clue as to what the market can do. High and low made by the previous weekly candle are important areas of support and resistance. Either price is going to breakout of this support/resistance or it will stay within it. So you should watch price as it nears weekly high and low made by the previous weekly candle.

After looking at the weekly candle, you should look at the daily candle. This gives you more information about the market. If you look at the weekly and daily chart above, you can clearly see that the market is in a bullish mood. So going long is a good idea. Once you have decided that going long is a good idea. you should then look at H4 chart and make your entry decision. A swing trading can continue for many days. So you should be patient when it comes to swing trading. Avoid overtrading at all costs. Overtrading is the killer of accounts. Watch this movie on a rogue trader who bought down a bank by overtrading.

When you are trading currencies, you should keep political events in views. Elections are very important events for a currency market. Outcome of elections can move the currency market big time. So you should keep a watch on the elections. As you can see French elections have important bearing on EURUSD. If you want to trade EURUSD, you should keep an eye on the political and financial events in Europe. A few years back, Greek Debt Crisis had cast a long shadow over EURUSD. Of course, you should also watch USA as USD is on the counter side of this pair. Federal Reserve FOMC Meetings have important impact on EURUSD. US Presidential Elections also have important impact on EURUSD. Read my Trading Ninja Blog for more insights on EURUSD.

Before I close this post, you should combine forex trading with binary options trading. This is what I do. I trade forex on H4 while on lower timeframes like 1 minute and 5 minute, I trade binary options on EURUSD. 5 minute EURUSD binary options trade can make you 88% return in just 5 minute. You can make 4-5 trades in less than 30 minutes. If you can win all these trades, you are done for the rest of the day. You can read this post on how to turn $100 into $1 million in 12 months trading binary options with a risk of 2%. As said above, my favorite pair for binary options trading is EURUSD. I trade binary options with expiry 5 minute. Just a few trades in a day can grow your account rapidly.

Now a days algorithmic trading has become very popular. Days of manual trading are coming to an end. More and more trading is being done by algorithmic trading systems. On Wall Street almost something like 80% of the trades are now a days being placed by algorithms. Algorithmic trading is not difficult at all. You can learn how to develop your own algorithmic trading strategies that work for both forex as well as binary options. I have developed this course R for Traders. This first course in a 3 part series course. R is a powerful machine learning and data science scripting language. You can download R software totally free. It is an open source project. There are more than 7000 data science and machine learning algorithms that you can use to develop your algorithmic trading strategies. After the first introductory course, you can take the second course Machine Learning Using R for Traders. This course teaches you how to do machine learning using R. Finally you are ready to develop your own algorithmic trading systems using R with this course Algorithmic Trading Using R.

EURUSD is a good pair to trade. It gives you a chance to catch the big moves something like 100-200 pips with a small stop loss of 10 pips. When you are trading, the ultimate thing is risk management. Never ever take risk management lightly. Always make sure you enter the market with a small risk. This is what I do. I try to make 100-200 pips with a small stop loss of 10-15 pips. Keep on reading my Trading Ninja Blog to know how I do it consistently.